The Philanthropic Community Can Help 250,000 New Yorkers Access $10 Billion in Loan Forgiveness: A Conversation on Public Service Loan Forgiveness

A Conversation with Rich Leimsider, Founder, PSLF.nyc, and Carolyn Peters, Manager, Learning Services, Philanthropy New York

The philanthropic community currently has the opportunity to help hundreds of thousands of people apply for Public Service Loan Forgiveness (PSLF). While PSLF has existed for 15 years, with the promise that anyone with a total of 10 years of government or nonprofit work experience would have all remaining student loans eliminated, in October 2021, the US Department of Education used emergency powers related to the COVID crisis to fix the program with the “PSLF Waiver” temporarily. This presents a significant opportunity for professionals in the philanthropic, non-profit, and human services sector to address the over 1.6 trillion dollars in student debt mainly held in Black and Brown communities.

Carolyn Peters, Philanthropy New York’s Manager of Learning Services, sat down with Rich Leimsider, the founder of PSLF.nyc, to speak about the concerted effort by city leaders, including government officials and the philanthropic community, to help 250,000 New Yorkers access Public Service Loan Forgiveness and the opportunities it provides regarding retention of public sector staff at a time of high attrition, poverty mitigation, and racial equity.

This is part one of a two-part conversation.

Rich: Hey Carolyn, thanks for having me today! I’m excited to chat with PNY, particularly given the opportunities that PSLF holds for funders and non-profit partners, but first, tell me about what you do.

Carolyn: Yeah, absolutely. I am a Learning Services Manager here at Philanthropy, New York. I joined in December of 2019, part-time and full-time in March of 2020. So that was an exciting period to transition. Before that, I was a Columbia University student pursuing a psychology and Hispanic studies degree. During my time on that campus, I really loved volunteering with programs that mitigate racial and educational inequities.

Rich: Oh, Columbia University, I think I’ve heard of that one! It sounds like you made the most of your college experience and are precisely the type of professional that this program provides such an opportunity. Let's chat!

Carolyn: Awesome sounds good. Well, now that I’ve told you a little about my experience with school, I want to hear more about yours. How was your educational experience, and what lit the flame in your passion on the journey to forgive student debt?

Rich: So I went to New York City Public schools, which I realize now ultimately makes me pretty fortunate. I went to sort of a mediocre middle school but was incredibly lucky to get into great magnet schools afterward.

Once I began to pursue higher education, I went to private undergrad, then went to the University of Texas for social work school, and Harvard Business School to get an MBA.

Unfortunately, that journey was both incredibly rewarding and incredibly expensive. At the time that I took my student loans, interest rates were low, which was sort of helpful for years and years.

Carolyn: I'm assuming that this sparked your involvement with Pubilc Service Loan Forgiveness? What can it mean for folks in New York City, or generally in the nation? Perhaps you can also share more about how you got energized by this new program.

Rich: Even with the low-interest rates, I had been paying off those loans for 20 years before they got forgiven, as was the same with those around me. My sister is 15 years into paying student loans, and my wife was piled with debt from medical school. With the two of us more than 20 years into paying off those loans, there have been numerous times that we have had to make decisions for our family based on the amount of debt we carried.

I am kind of a finance nerd who likes doing my own taxes, and I've known about the Public Service Loan Forgiveness program for years. I applied in 2018 and was rejected for nonsense bureaucratic reasons. At the time, the program had been around for 15 years, and it has honestly been a stinker the whole time, but I'm stubborn enough to keep trying. So I saw that there was this thing called the PSLF Waiver back in the fall of 2021. I can be persistent, so I thought, "Okay, let me keep banging my head against the wall and see what's possible.” I tried again, and then I forgot about it because I knew that this program had disappointed millions of people for more than a decade. I honestly didn't really get my hopes up, but then, on May 11, 2022, I logged on and saw that all of my student loans had been set to zero and that every dollar I owed after the first 20 years was completely gone. That was a pretty remarkable moment. To put the icing on the cake, a week later, the government decided I had made an overpayment on my student loans, and they put 14 months of payments into my bank account. So I logged on to my bank account, and I saw 14 payments from the United States Treasury coming right in.

I felt like I had experienced an Old Testament miracle and saw the light, and I couldn't stop talking to everybody about how lucky I was, how unexpected this was, and I had to bring the good word to, you know, everyone I could find, and eventually, after annoying enough people about it, one of my friends said, you know, maybe there's a coalition here. There was a massive opportunity for a lot of New Yorkers, and if we could kind of explain what this program was and how it worked and if we could change the lives of hundreds of thousands of folks.

Carolyn: That's an incredible story, especially given that it starts with one of the most frustrating disappointments – dealing with government bureaucracy. I would imagine that shifting that disappointment into a story of hope and the ability to change the financial well-being of so many was inspiring and a message that needs to be shared, so thank you for all of the work that the coalition is doing.

Rich: Thank you, Carolyn, but about you? I’m curious to hear the story of someone who's a few years out of college and navigating the student debt landscape. Do you have student loans, and have you had a chance yet to run the help tool at StudentAid.gov/PSLF?

Carolyn: I do, actually. As someone who also does their own taxes and is a self-proclaimed finance nerd, I found this immediately piqued my interest. I have a mixture of both private and federal loans. When I heard about this, I thought to myself, “Oh, well, a lot of my loans are private, surely this doesn't apply,” until I realized I have Government loans, and it would be a huge weight off of my shoulders to be free of them.

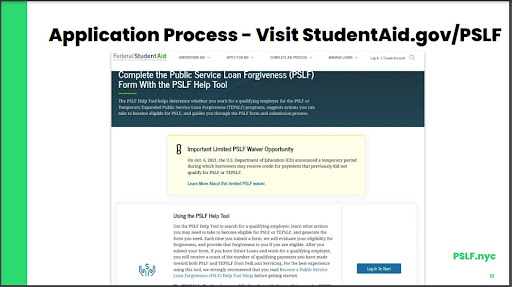

I ended up running the tool and yes, I found it incredibly helpful. Yeah, I'm glad it was such a straightforward process, and I think it was the most straightforward process I had on any Federal financial application. One thing I learned in this process that may have had the biggest impact on me was the fact that the three years that I have in the field thus far contribute to PSLF. This was not a career trajectory that I planned to have but knowing that the work that I’ve put in so far can go towards essentially paying off my education is terrific.

Rich: I love hearing that, and the tagline that we need is that “it was the most straightforward process I had on any Federal financial application.” This work is essentially a combination of a get-out-the-vote campaign and a benefits access program. What’s important about this, and I think especially useful for The Philanthropy New York community to know, is this is way easier than most benefits access work. Folks don’t all have to be process nerds like you and me, who like love to do all of it. You can literally sit down and log in with your social security number, and the Federal Government already knows everything about your loans. So the campaign really is an awareness campaign of getting people to go to that website and not having to teach people a lot about, you know, understanding specific financial situations.

That’s also one of the reasons why it's so exciting to think about funders and grantmakers reaching out to the grantee community, in addition to employees at foundations and grant-making intuitions. People across the philanthropic ecosystem will largely be eligible for the program, and if we can get thousands of people in that ecosystem to apply, we're going to bring billions of dollars into our community, liberating individuals and families from the shackles of student debt.

Carolyn: So with that in mind, as we think about our philanthropic community, what benefits do you see PSLF giving them?

Rich: Number One is definitely economic development. If fully utilized, this program can bring in 10 billion dollars of Federal money into the city of New York. The impact is substantial not just on people whose loans are forgiven but on everyone around them. If someone has $50,000 less debt and is not making a $500 a month payment, everyone around them feels that’s hugely important.

But you know, additionally things specifically for the philanthropic community. This is massive employee retention and incentive program. We are saying that for people who stick around in the sector for ten years of work, all of their loans will be forgiven. That's an incredible message to be able to share for people coming into the field but also a really important message to share with folks that have been there four years, five years, or six years as well when highlighting the benefit of sticking around and building a career in the sector.

We're talking about people on staff who may have $10,000 in debt, and we're saying stick around with us for three more years for PSLF, which, if we thought about it like additional income, would be a $33,000 bonus every year for the next three years, just for making it to that 10-year mark.

** Keep an eye out in September for part two of this conversation! **

Philanthropy New York is proud to partner with the PSLF.nyc Campaign, a coalition of nonprofits, government agencies, and labor unions, to spread the word. The PSLF Waiver is temporary and only lasts until October 31, 2022. Take action to have your own loans forgiven and spread the word to the grantee community.

Use the 20-minute Help Tool StudentAid.gov/PSLF to see if you are eligible. Or sign up for a free webinar:

Tuesday, August 16 at 10:00 am — Register

Thursday, August 25 at 2:00 pm — Register

Tuesday, August 30 at 10:00 am — Register